🔎 Disclosure: Heads up, babe: some links here are affiliate links, which means you might throw a tiny commission my way if you buy (zero extra cost to you). Only things you’d actually use and love get shared on this site.

1. They Finance Everything Instead of Owning It

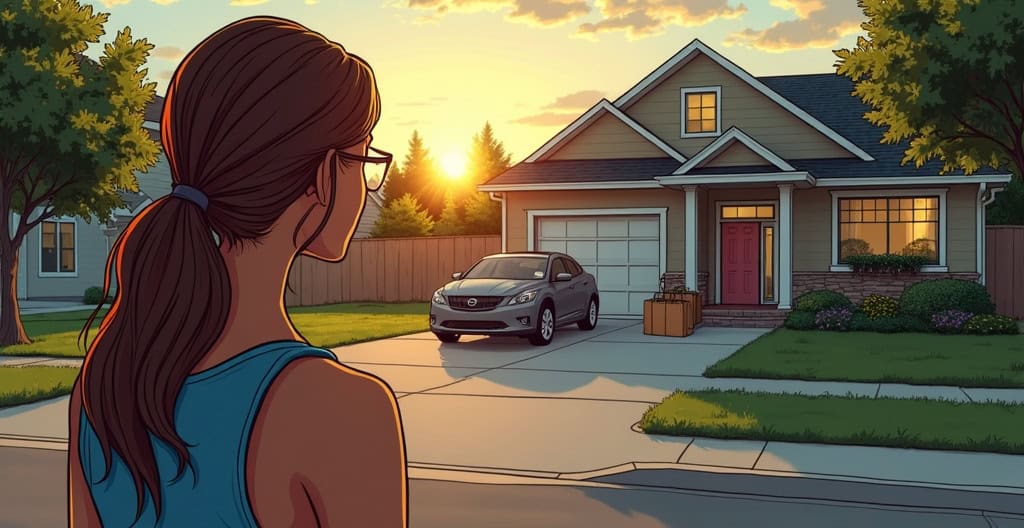

You see that shiny SUV in their driveway? Yeah, it’s not really theirs.

Most people “look” rich because they’re paying for everything monthly. And those payments add up fast.

They’re not ahead financially. They’re just really good at making debt look glamorous.

Here’s what’s usually behind the curtain:

- Car payments that eat up hundreds monthly for years.

- Furniture bought on installment plans loses value the second it’s delivered.

- Credit cards covering “lifestyle” upgrades that they couldn’t afford in cash.

👉 Here's How You'll Do It: Skip financing whenever possible. Save up and buy used or smaller instead.

Make It Easy: Consider using a budget binder to track what you truly own versus what you owe. It’s oddly satisfying to see it on paper.

2. They Spend Big to Keep Up Appearances

You know that one neighbor who always has a new patio set every summer? Yeah, that’s not “success”. That’s pressure with a credit limit.

Many people spend just to keep up with the image of success, not actual security.

They trade peace of mind for quick approval from others.

Look closely, and you’ll notice:

- Constant home upgrades that don’t actually increase value.

- Designer clothes and accessories that get worn twice, then forgotten.

- Frequent dining out to “keep up” with social expectations.

👉 Here's How You'll Do It: Focus on what feels rich, not what looks rich. like debt-free peace or a growing savings account.

Make It Easy: Grab a cash envelope wallet to stick to a weekly fun-spending limit. It’ss a visual reminder to stay grounded.

3. They Neglect Saving Because “They’ll Earn More Later.”

This one’s a classic trap.

They tell themselves, “Once I get that raise, I’ll start saving.” Spoiler: that raise comes and goes. So does the money.

They’re banking on the future instead of protecting the present.

Here’s how that mindset usually looks:

- No emergency fund, so one flat tire becomes a mini financial crisis.

- Big vacations instead of building a cushion.

- Overconfidence that future income will fix current habits.

👉 Here's How You'll Do It: Start small. automate even $25 a week into savings so it’s painless and consistent.

Make It Easy: Open a Betterment Cash Reserve Account to automate small transfers into an emergency or goal-based fund.

4. They Lease Fancy Cars They Can’t Afford

That “dream car” parked outside? It’s not a dream. It’s a lease.

Most of the time, they’re driving for status.

They pay hundreds each month just to look like they’ve made it, but they’re renting their image.

Here’s what you might not see:

- Leases with high monthly payments that reset every few years.

- Expensive insurance premiums because the car must stay pristine.

- No asset ownership, just a cycle of borrowed luxury.

👉 Here's How You'll Do It: Drive what’s paid off or buy a reliable used. It’s freedom disguised as simplicity.

Make It Easy: Get a car care kit to keep your ride looking brand-new for years without new car payments.

5. They Look Rich, But Have Nothing Saved

They might have luxury bags, trendy decor, and a kitchen straight off Pinterest. But open their bank app and… yikes.

They’re running on fumes while pretending to have everything figured out.

Looking wealthy is easy. Being wealthy, not so much. It’s discipline, routine, and quiet choices that no one claps for.

Here’s how to spot the difference:

- They brag about purchases, not progress.

- They have zero savings goals or investments.

- Their “security” is their next paycheck.

👉 Here's How You'll Do It: Build quiet wealth. automate savings, pay down debt, and let results speak for themselves.

📌 SAVE IT FOR LATER! 📌